Private & Investment banking.

Private & Investment banking.

Stats at a glance

We let the results speak for themselves.

80 Years

Private Banking

and Fiduciary Services

5 Regional

Offices

$36 Billion

AUM

Our Offices

We are eager to help you , for security and comfort , all our branches charter clients and visitors.

New York, United States

Americas Branch

Is not only the city , that never sleeps, here dream flourish or plummet, for sure a place to be .

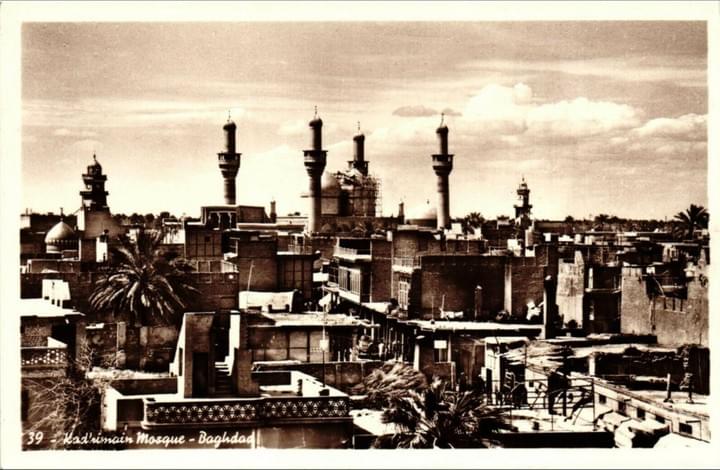

Dubai, United Arab Emirates

EMEA Branch

Dubai has become in the last few decades? In the middle of the 20th century, the city (and its home country, the United Arab Emirates), relied mostly on trade, but the discovery of oil reserves helped them skyrocket into prosperity.

Singapore , Singapore

Asian & Pacific Branch

Is not only , modern and sophisticated, an economical example.

Tel Aviv , Israel

CIS Branch

The Silicon Valley of the Middle East

Toronto , Canada

Treasury & Funds Management

Tolerant and stable, full of opportunities

Bangalore, India

Southern Asian Regional Branch

The center of India's high-tech industry

Johannesburg, South Africa

Africa Branch

A promising and prosperous global city

Our services

We proud ourself to offer tailored solutions

Asset optimization

Nothing more real , than real estate

Wealth Management real estate asset managers are experienced in asset and property management for residential, commercial, agricultural, timber, vacant, and development properties. Our goal is to optimize your portfolio’s potential while addressing the specific risks and challenges of real estate management.

Transitioning

Growing without pains

Whether you want to sell your business outright, transition to the next generation, or have your current employees take ownership, our team can help. We provide you and your professionals with access to highly-specialized business advisory and valuation services.

Liquidity

Calm and refreshing

Your income may fluctuate substantially during the year due to the timing of dividends, sales commissions, partnership distributions, or other periodic sources of income. Appropriate use of credit strategies can help smooth out your cash flow. Obtaining access to funds can help you maintain liquidity and meet financial commitments without depleting your cash reserves.

Heritage

Because drama is just good on TV

We offer multigenerational and dynasty trust planning and administration. We also can act as executor or trustee for your estate documents, should you need an impartial, objective party to serve in that capacity.

Convenience, not lifestyle

They ain’t vanity, we understand

Whether you need a loan, line of credit, a customized credit solution for commercial real estate, or specialized financing for aircraft, a life insurance premium, or fine art purchases, you can depend on your team of specialists to provide options to meet your borrowing needs.

Strategies

Debt Optimization

Interested in borrowing without selling assets? Strategic borrowing, when used appropriately, can benefit you if you have significant assets that are illiquid. If you want to manage a tax liability, have a concentrated stock position, or if you simply want access to funds while retaining assets, a carefully structured loan can be an effective financial tool.

Citizen of the world

For the global nomad in you.

We provide experienced and customized asset management in multiple jurisdictions for international clients. Together, we can develop a plan to help you preserve your assets, potentially reduce risk and taxes, and maintain your privacy.

When everything count

An extra set of eyes

Let our specialists help you navigate the complexity of managing oil, gas and mineral assets in fast-changing market conditions. Services include lease negotiation, cash flow management, and monitoring contracts.

Evolving

By keeping our values, we succeed

My family founded this institution in order to facilitate commerce and preserve wealth .

Our tools have became sophisticated, but our values , guide us to endure, delivering profitability successfullduring 8 decades to our clients

Patronage

Only hate is unwelcome

Our institution, sponsor art , sport and science, In a diverse and respectful approach.

Our Team

Dr Shlomo Ovadiah

Chief Economist & President

Sheikh Asif ibn Nazzer

Head of Shariah Counsel

Esteban Barnea

Vice President

Europe Operations

Rosa Mermelstein

Vice President

America Operations

Dr Anita Singh

Vice President

South Asia Operations

Sabrina Ibramov

Head of Crypto Assets

Hellen Betancourt

Head of Customer Service

- Contact Us

Looking forward for your comments...

For resources such as:

Annual Results

Investment Scope

Invest/nest. Prospectus

Please contact us .

Contact Us

Info@

Wadiah Capital is an Capital trust and banking holding operating in several Jurisdictions (please contact your account manager to know the jurisdiction that applies to your booking )

Complying with the applicable regulations and guidance set forth by:

Securities Exchange Comission of the USA, Rule 202(a)(11)(G)-1, Rule D 506. (for USA CLIENTS ONLY ) for Recognised securities under this jurisdiction) Secretary of Treasury of the USA, Bank Secrecy Act (BSA), Office of Foreign Assets Control, Office of the Comptroller of the Currency (US dollar transactions for reporting only)

European UNION

Implementing Regulation Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC (1), and in particular Article 35(5), Article 36(5) and Article 39(4) thereof, (EU No 926/2014 of the European Commission of 27.08.2014

COMMISSION DELEGATED REGULATION (EU) No 1151/2014 of 4 June 2014 Financial Services and Capital Markets Union (European Sanctions )

DIRECTIVE (EU) 2019/2034 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 27 November 2019 on the prudential supervision of investment firms and amending Directives 2002/87/EC, 2009/65/EC, 2011/61/EU, 2013/36/EU, 2014/59/EU and 2014/65/EU

DIRECTIVE (EU) 2021/338 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 February 2021 amending Directive 2014/65/EU as regards information requirements, product governance and position limits, and Directives 2013/36/EU and (EU) 2019/878 as regards their application to investment firms, to help the recovery from the COVID-19 crisis.

Durchführungsverordnung zur Richtlinie 2013/36/EU des Europäischen Parlaments und des Rates vom 26. Juni 2013 über den Zugang zur Tätigkeit von Kreditinstituten und die aufsichtsrechtliche Überwachung von Kreditinstituten und Wertpapierfirmen, zur Änderung der Richtlinie 2002/87/EG und zur Aufhebung der Richtlinien 2006/48/EG und 2006/49/EG (1), insbesondere Artikel 35 Absatz 5, Artikel 36 Absatz 5 und Artikel 39 Absatz 4, (EU Nr. 926/2014 der Europäischen Kommission vom 27.08.2014)

DELEGIERTE VERORDNUNG (EU) Nr. 1151/2014 der Europäischen Kommission vom 4. Juni 2014 über Finanzdienstleistungen und die Kapitalmarktunion (Europäische Sanktionen)

RICHTLINIE (EU) 2019/2034 DES EUROPÄISCHEN PARLAMENTS UND DES RATES vom 27. November 2019 über die aufsichtsrechtliche Überwachung von Wertpapierfirmen und zur Änderung der Richtlinien 2002/87/EG, 2009/65/EG, 2011/61/EU, 2013/36/EU, 2014/59/EU und 2014/65/EU

RICHTLINIE (EU) 2021/338 DES EUROPÄISCHEN PARLAMENTS UND DES RATES vom 16. Februar 2021 zur Änderung der Richtlinie 2014/65/EU in Bezug auf Informationsanforderungen, Produktgestaltung und Positionsbeschränkungen sowie der Richtlinien 2013/36/EU und (EU) 2019/878 in Bezug auf ihre Anwendung auf Wertpapierfirmen zur Bewältigung der COVID-19-Krise.

Règlement d'application de la Directive 2013/36/UE du Parlement européen et du Conseil du 26 juin 2013 relative à l'accès à l'activité des établissements de crédit et à la surveillance prudentielle des établissements de crédit et des entreprises d'investissement, modifiant la Directive 2002/87/CE et abrogeant les Directives 2006/48/CE et 2006/49/CE (1), et en particulier les articles 35(5), 36(5) et 39(4) de celle-ci, (UE n° 926/2014 de la Commission européenne du 27 août 2014

RÈGLEMENT DÉLÉGUÉ (UE) N° 1151/2014 de la Commission européenne du 4 juin 2014 sur les services financiers et l'Union des marchés des capitaux (Sanctions européennes)

DIRECTIVE (UE) 2019/2034 DU PARLEMENT EUROPÉEN ET DU CONSEIL du 27 novembre 2019 sur la surveillance prudentielle des entreprises d'investissement et modifiant les Directives 2002/87/CE, 2009/65/CE, 2011/61/UE, 2013/36/UE, 2014/59/UE et 2014/65/UE

DIRECTIVE (UE) 2021/338 DU PARLEMENT EUROPÉEN ET DU CONSEIL du 16 février 2021 modifiant la Directive 2014/65/UE en ce qui concerne les exigences en matière d'information, la gouvernance des produits et les limites de position, et les Directives 2013/36/UE et (UE) 2019/878 en ce qui concerne leur application aux entreprises d'investissement, pour contribuer à la reprise de la crise du COVID-19.

واديا كابيتال هي شركة ثقة رأس مالية ومصرفية تعمل في عدة سيادات (يرجى الاتصال بمدير حسابك لمعرفة السيادة المنطبقة على حجزك)، وذلك وفقًا للوائح والإرشادات السارية المعمول بها:

- هيئة تبادل الأوراق المالية في الولايات المتحدة الأمريكية، القاعدة 202 (أ) (11) (ج) -1، القاعدة D 506. (للعملاء في الولايات المتحدة الأمريكية فقط) للأوراق المالية المعترف بها في هذه السيادة، وزارة الخزانة الأمريكية، قانون السرية المصرفية (BSA)، مكتب مراقبة الأصول الأجنبية، مكتب المراجع العملة (معاملات الدولار الأمريكي للإبلاغ فقط)

- الاتحاد الأوروبي تنفيذ توجيه اللائحة 2013/36 / الاتحاد الأوروبي للبرلمان الأوروبي ومجلس الاتحاد الأوروبي بشأن الوصول إلى نشاط المؤسسات الائتمانية والرقابة الاحتياطية على المؤسسات الائتمانية وشركات الاستثمار، وتعديل التوجيه 2002/87 / الاتحاد الأوروبي وإلغاء التوجيهات 2006/48/ الاتحاد الأوروبي و 2006/49/ الاتحاد الأوروبي (1)، وخاصة المادة 35 (5)، المادة 36 (5) والمادة 39 (4) منه، (الاتحاد الأوروبي رقم 926/2014 من المفوضية الأوروبية بتاريخ 27.08.2014

- تنظيم المفوضية المفوض (الاتحاد الأوروبي) رقم 1151/2014 بتاريخ 4 يونيو 2014 الخدمات المالية والاتحاد لأسواق رأس المال (العقوبات الأوروبية)

- التوجيه (الاتحاد الأوروبي) 2019/2034 للبرلمان الأوروبي ومجلس الاتحاد الأوروبي بتاريخ 27 نوفمبر 2019 بشأن الرقابة الاحتياطية على شركات الاستثمار وتعديل التوجيهات 2002/87 / الاتحاد الأوروبي، 2009/65 / الاتحاد الأوروبي، 2011/61 / الاتحاد الأوروبي، 2013/36 / الاتحاد الأوروبي، 2014/59 / الاتحاد الأوروبي و 2014/65 / الاتحاد الأوروبي